Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Points

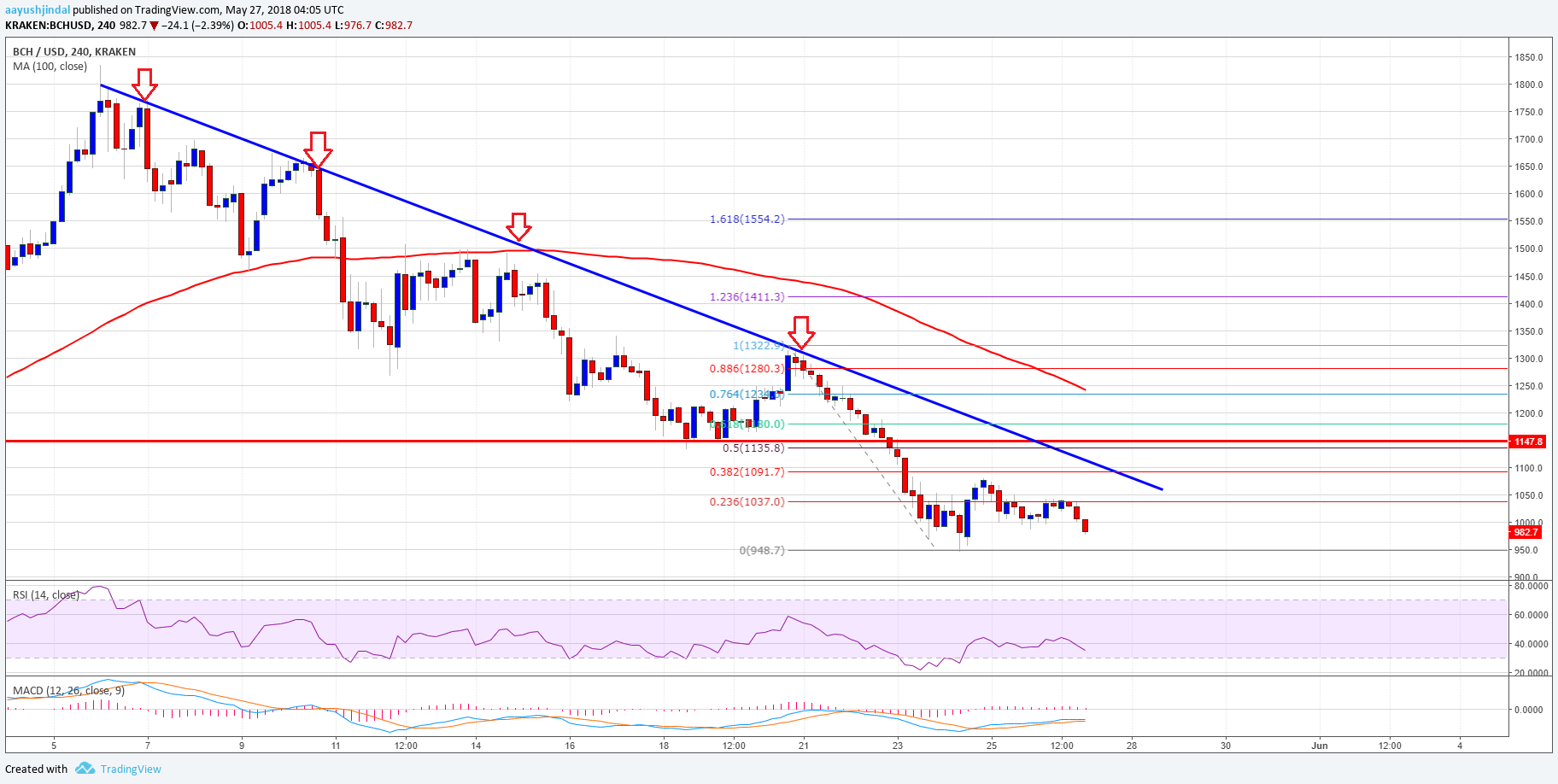

- Bitcoin cash price remained under pressure and declined below the $1,000 support against the US Dollar.

- There is a monster bearish trend line in place with resistance near $1,060 on the 4-hours chart of the BCH/USD pair (data feed from Kraken).

- The pair is likely to decline further and it could even break the last swing low of $948 in the near term.

Bitcoin cash price is in a bearish trend below $1,080 against the US Dollar. BCH/USD remains at a risk of more declines towards the $920 and $850 levels.

Bitcoin Cash Price Decline

This past week, there were sharp declines from the $1,100 swing high in bitcoin cash price against the US Dollar. The price declined and broke a few important support levels such as $1,050 and $1,000. It traded towards the $950 level before starting an upside correction. A low was formed at $948 and the price corrected above the 23.6% Fib retracement level of the last decline from the $1,322 high to $948 low.

However, the upside move was capped by the $1,050 resistance. It also failed to test and break the 38.2% Fib retracement level of the last decline from the $1,322 high to $948 low. BCH price is declining once again and it seems like it could retest the $948 low in the short term. A break below $948 could open the doors for a test of the $920 and $900 support levels. To the topside, there is a monster bearish trend line in place with resistance near $1,060 on the 4-hours chart of the BCH/USD pair.

Looking at the chart, the price is facing a tough challenge on the upside near $1,060 and the trend line. Above this, the last swing high of $1.150 is the next major hurdle for buyers.

Looking at the technical indicators:

4-hours MACD – The MACD for BCH/USD is mostly negative in the bearish zone.

4-hours RSI (Relative Strength Index) – The RSI for BTC/USD is declining towards the 30 level.

Major Support Level – $950

Major Resistance Level – $1,060