It’s Tuesday morning and it’s time to set up our strategy for the day’s trading in the bitcoin price in Europe. Action overnight was pretty good to us in the sense that we were able to jump in and out of the markets not just for a nice breakout trade but also for a breakout trade in our favorite direction – the upside. This is always a sort of double whammy trade since we’re not only taking profit on our initial intraday position but also long-term holdings are appreciating in value.

So, let’s get things in place.

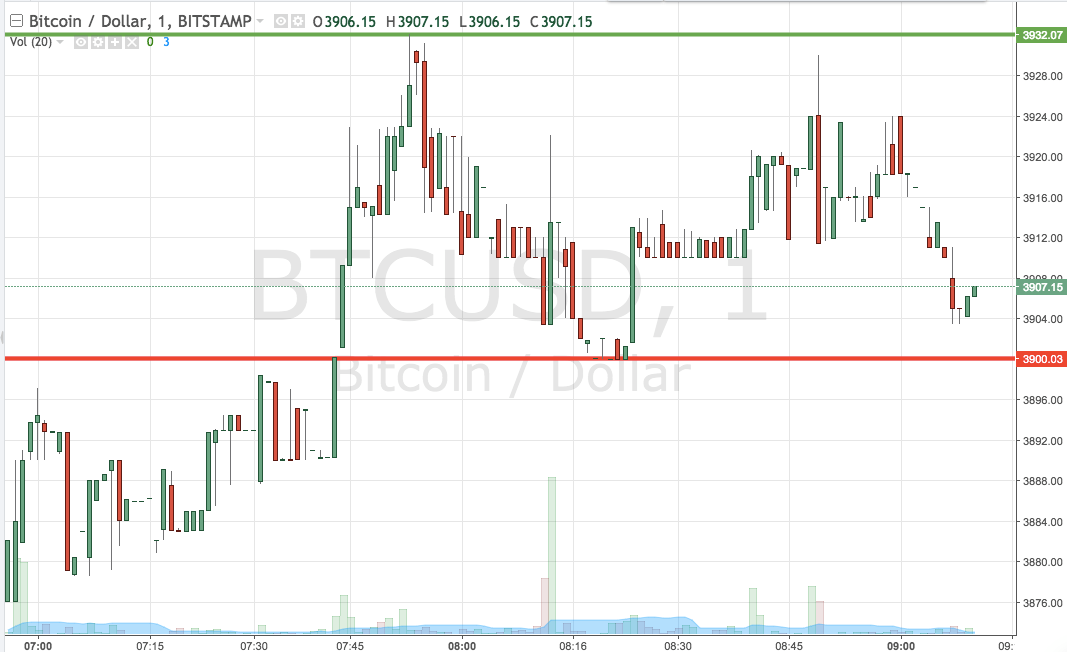

As ever, take a quick look at the chart below before we get started so as to get an idea where things stand and where we are looking to jump in and out of the markets according to the rules of our intraday strategy. It’s a one-minute candlestick chart and it’s got our key range overlaid in red and green (a little bit fancier today than our normal red-only pattern!)

As the chart shows then, the range that we have got in place for our European session intraday efforts comes in as defined by support to the downside at 3900 flat (a very strong level, with any luck) and resistance to the upside at 3932.

4000 is the big target here and, if we see a break above resistance we may well get a run all the way up to the psychologically significant levels. With that in mind, then, our upside strategy for the early session is to enter long on a close above 3932 towards a target of 4000 flat. A stop on the trade at 3920 looks good from a risk management perspective.

Looking the other way, if we see a close below support, we’ll jump in short towards a downside target of 3850.

Let’s see how things play out.

Charts courtesy of Trading View