Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

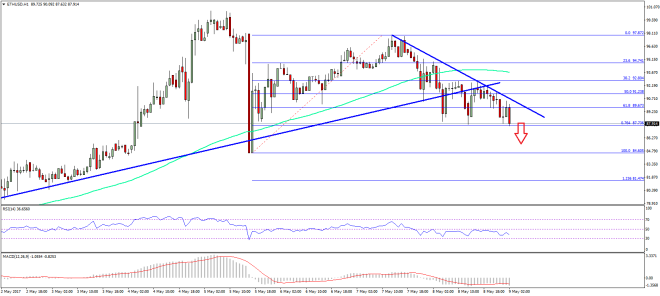

- There was an extended decline in ETH price, as it broke the $92 support against the US Dollar.

- Yesterday’s highlighted major connecting bullish trend line with support at $91.50 on the hourly chart (ETH/USD, data feed via SimpleFX) was broken.

- The price may decline further towards $84 in the short term if sellers remain in action.

Ethereum price struggled to hold gains against the US Dollar and Bitcoin, and ETH/USD recently broke a major support for short-term downside move.

Ethereum Price Downside Move

Yesterday, we discussed that there can be a minor dip in ETH price towards $90 against the US Dollar. The price did move down after failing to break the 76.4% Fib retracement level of the last decline from the $100.62 high to $84.65 low. The price started moving down, and broke the $95 support. The worst thing was a break below the 100 hourly simple moving average at $94.20.

Later, the price extended its decline and broke the $92 support. Moreover, yesterday’s highlighted major connecting bullish trend line with support at $91.50 on the hourly chart of ETH/USD was cleared. These all were bearish signs ignited a downside move below $90. Later, the price moved below the 61.8% Fib retracement level of the last wave from the $84.60 low to $97.87 high.

At the moment, the price is trading near the $88-87 swing low. It also coincides with the 76.4% Fib retracement level of the last wave from the $84.60 low to $97.87 high. So, there is a chance of a minor rise towards $89.50 where it may find resistance near a bearish trend line. Overall, it looks like the recent short-term break may ignite more losses towards $85-84.

Hourly MACD – The MACD is just moving nicely in the bearish zone.

Hourly RSI – The RSI is currently moving lower, and well below the 50 level.

Major Support Level – $84

Major Resistance Level – $90

Charts courtesy – SimpleFX