Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

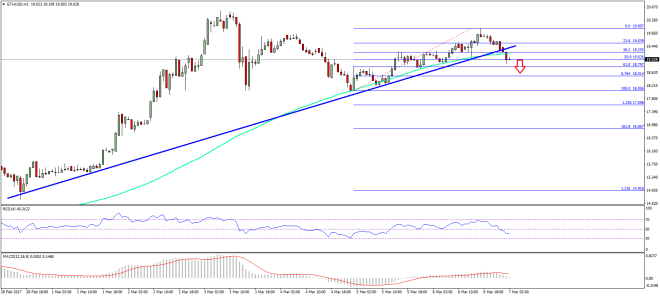

- ETH price managed to correct towards $19.99 where it found sellers and moved down.

- It broke a major bullish trend line with support at $19.25 on the hourly chart (ETH/USD, data feed via SimpleFX).

- The price is also below the 100 simple moving average and $19.20, which is not a good sign in the short term.

Ethereum price is currently trading lower below $19.20 against the US Dollar, and it looks like ETH/USD might extend the current downside move.

Ethereum Price Downside Break?

Yesterday, we saw a correction wave towards $19.80-90 in ETH price vs the US Dollar. The price traded as high as $19.99 where it found sellers. It also managed to break the 50% Fib retracement level of the last drop from the $20.54 high to $18.05 low. However, it failed to break the 76.4% Fib level of the same wave. It resulted in a downside move, as the price broke the $19.50 support.

During the downside move, there were two important breaks. First, a major bullish trend line with support at $19.25 on the hourly chart (ETH/USD, data feed via SimpleFX) was cleared. Second, the price settled below 100 simple moving average at $19.20. This means the price is now at a risk of a downside move. It already cleared the 38.2% Fib retracement level of the recent move from the $18.05 low to $19.99 high. If the ETH sellers manage to push the price below $19.00, there can be more declines.

Alternatively, we can say a break below the 61.8% Fib retracement level of the recent move from the $18.05 low to $19.99 high at $18.79 might open the doors for $18.05 in the short term.

Hourly MACD – The MACD is almost done with the bullish zone, and about to change the slope.

Hourly RSI – The RSI has moved below the 50 level, which is a bearish sign.

Major Support Level – $19.00

Major Resistance Level – $19.40

Charts courtesy – SimpleFX