Bitcoin Price Key Highlights

- Bitcoin price is slowly treading higher, following a small bullish breakout seen earlier.

- Buyers seem to be putting up a strong fight but are still hesitant to pile on large positions due to potential Chinese government regulation.

- Price is currently testing support and might be due for a quick bounce to the resistance.

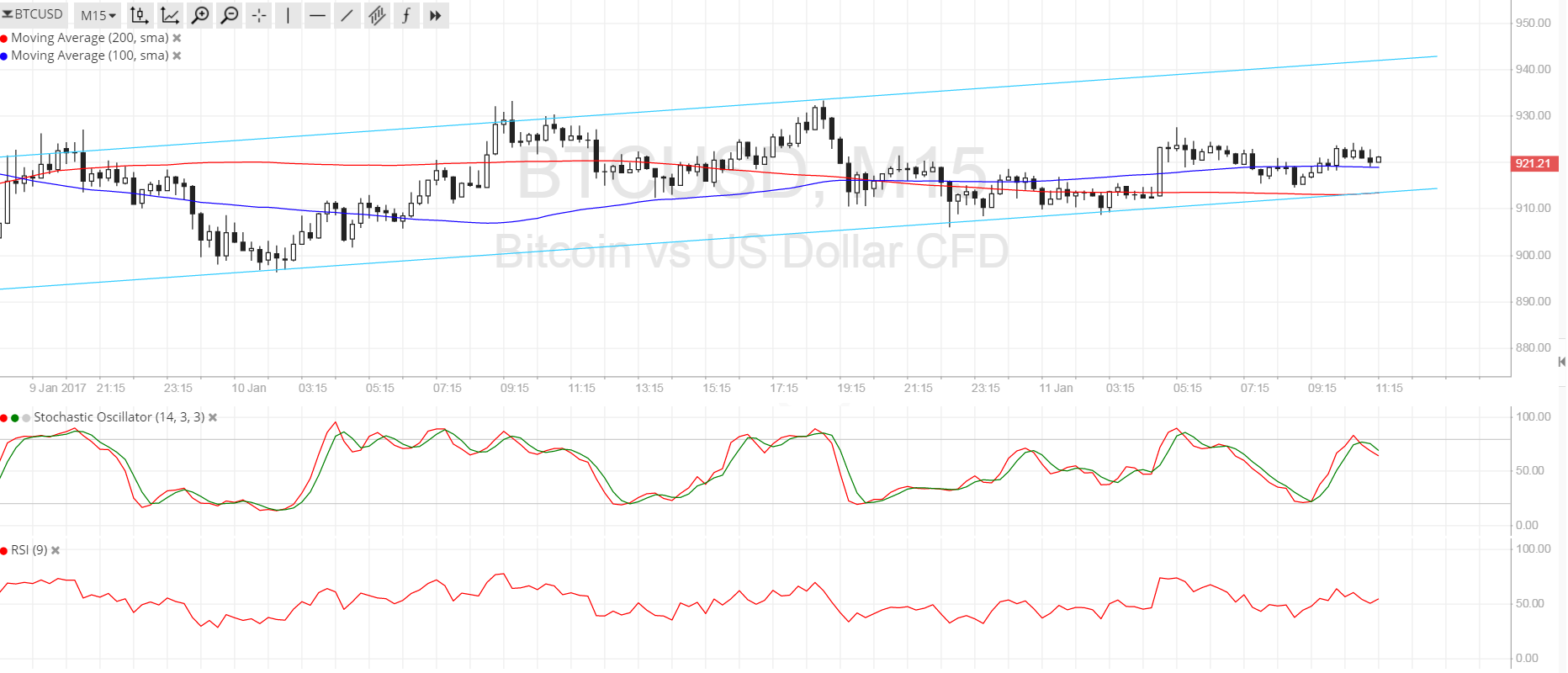

Bitcoin price is stuck in consolidation but a small bullish channel can be seen on its short-term time frames, offering opportunities to catch the climb.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA so the path of least resistance is to the upside. Also, the 200 SMA lines up with the channel support around $915, adding to its strength as a floor. Price is trading close to the 100 SMA at the moment and this could also hold as dynamic support.

Stochastic is turning lower from the overbought zone to suggest a pickup in selling pressure. If bears are strong enough, they could push for a break below the channel support and a test of the next floor around $880. On the other hand, a bounce off the channel bottom could spur a climb up to the top at $940.

RSI is treading sideways, barely offering any strong directional clues at the moment. This could mean that further consolidation is in the cards while traders await bigger market catalysts.

Market Events

The Chinese government’s warnings and actions a few days back has still crippled bitcoin trading activity, particularly in the mainland. Authorities have warned about the risks involved in trading bitcoin and reminded exchanges to implement KYC and AML checks on its clients, something that goes against the nature of the cryptocurrency.

Still, it’s also worth noting that the massive slide that resulted from liquidation of large positions has halted. Investors are taking it easy from here and might be waiting for the situation to calm before reestablishing larger long positions. At the same time, traders are also on the lookout for additional moves from Chinese officials as a cue to pare more bullish positions.

Charts from SimpleFX